The media exposes us all to tales of larger than life prognosticators on an almost daily basis. The Nate Silvers, Jim Cramers, Elon Musks, street-side psychics and other Nostradamus contemporaries play on our human sensitivities. Our brains dislike the uncertainty of a messy world, and so we prefer to believe the world is deterministic and can ultimately be reasoned about, if not explicitly understood. Success can then be achieved by following steps revealed by this understanding.

For many these icons, and their ability to make accurate predications, serve as proof-in-kind that their world must make sense.

But this is not the case. None of these actors possess a genetic mutation that makes the future less opaque. They were not born special. They are not inherently extraordinary, and neither are their predictions.

In today’s world there is no shortage of opinions, no scarcity of viewpoints. So presuming that at least one voice in the crowd gets it right, some individuals in any group are seers apparent.

Take the recent election as an example

Let’s say, for the sake of argument that 1,000 predictions were made publicly on blogs, on television and in research papers. There are only two possible outcomes: Donald Trump or Hillary Clinton.

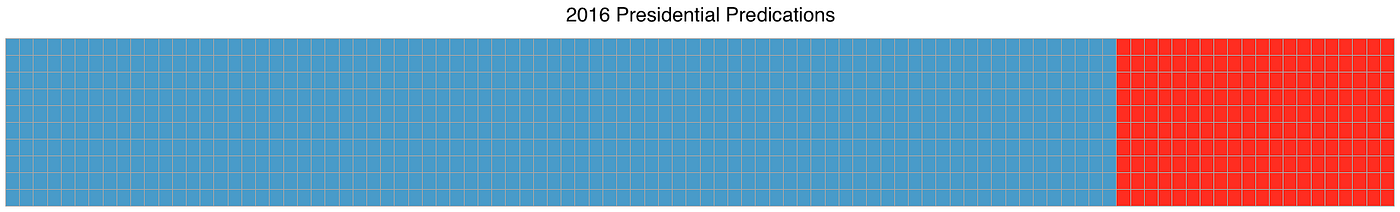

Now let’s say that 80% of the predictors had Clinton winning, and the other 20% had Trump winning:

After the election we know that 80% were wrong, and 20% were right, and we find ourselves in awe of this insightful minority of 200. We begin to ask “How did you know this would happen?” as if it is already a foregone conclusion that these individuals performed an extraordinary feat. This is evident in the coverage past seers enjoy before and after the elections:

A Washington Post article about American University’s Allan J. Lichtman

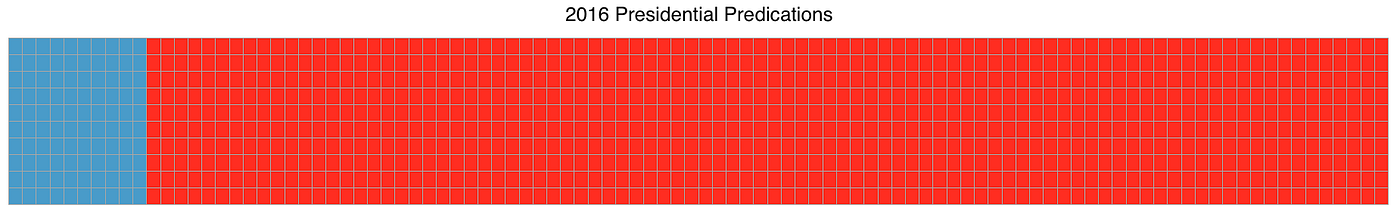

So now let’s imagine some changes in our initial conditions. Instead of 80% Clinton & 20% Trump let’s say the predictions were 90% Trump, 10% Clinton.

Now being in the Trump camp pre-election does not seem impressive. Your win would likely be overshadowed by coverage of a Clinton-predictor explaining why he was so sure his camp would come out on top. Economics tells us that scarcity determines value so there’s no surprises that society values the minority viewpoint, especially if it is right. So if you picked Trump you were right, but you might as well have predicted a sunrise. No one will care.

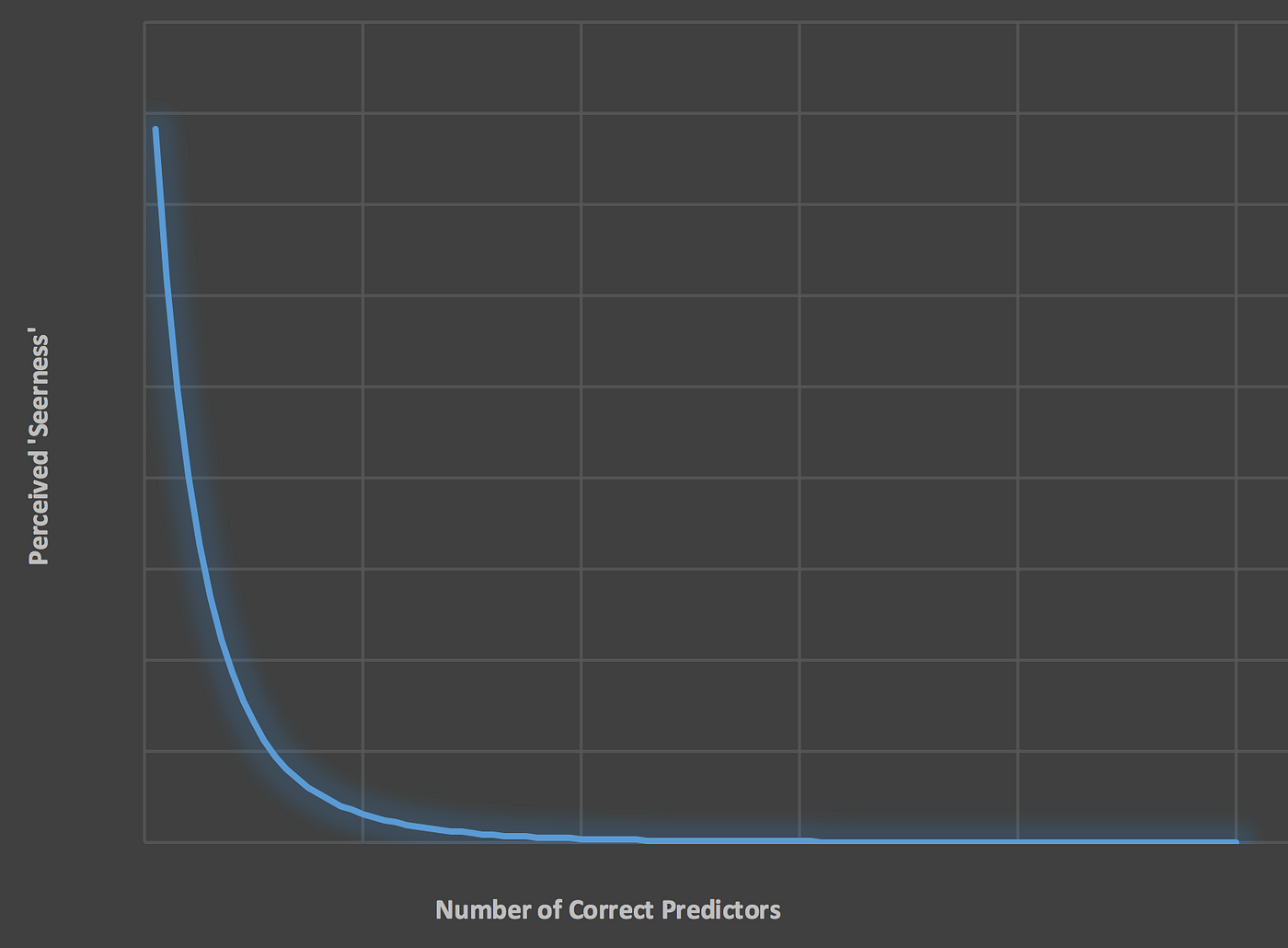

So to be become a perceived seer in the crowd you must:A) Be CorrectB) Have stood (nearly) alone by;C) betting on something not obvious

D) [bonus points] if you’re the first to say it and/or a large pre-existing platform

To be clear, yes these are also the rules of gambling.

The more unique you are in your predications, the more insightful you appear. This can be represented as a power law with the most valuable increases to one’s reputation occurring when the number of other correct predictors is at its lowest.

But surely these people are special? Surely they’ve understood something no one else has? There’s skill involved in all this? To find out answer let’s go back to our election predictors one last time.

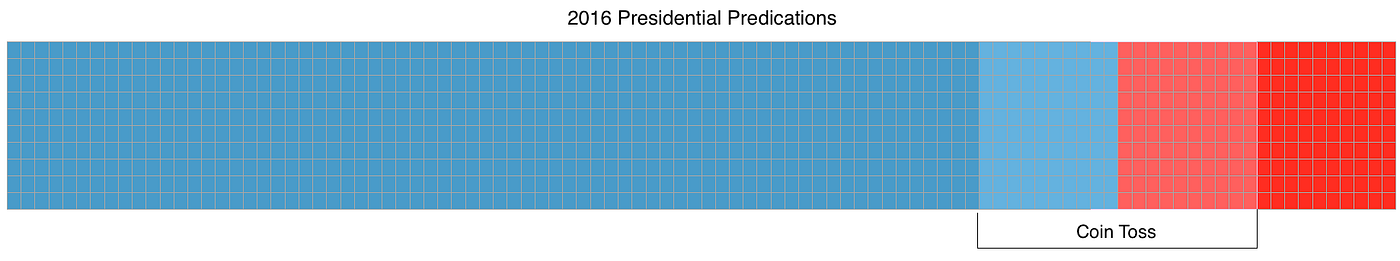

This time let’s assume that 70% go Hillary, 10% go Trump, and 20% decide with flip a coin toss. As a result 80% go Hillary and 20% go Trump, the same as our first example where the scarcity of Trump predictors made each of their insights seem profound.

However while half of those Trump predictors surely had complex models, evidence and tightly controlled data by which they based their claims, the other 10% relied on pure chance.

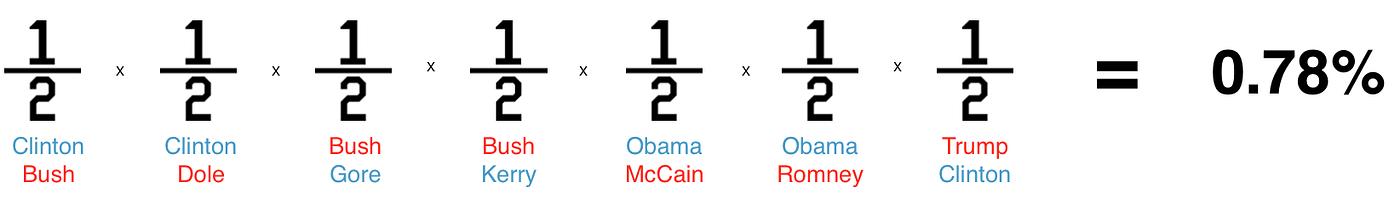

This also helps us understand why the long term winners such as Allan J. Lichtman, the man with a 30 year record of predicting presidents, has an unimpressive track record. In reality the chance of matching Lichtman’s record with a coin toss is just under 1%. 1 person, out a sample of 100, should match him by chance alone.

By chance alone, 1 in 100 people would match Lichtman’s Presidential Election Track Record

The fact that some people have gotten the market trends right for an entire quarter, or predicted a series of elections should not surprise us. Out of a field of millions of guessers, statistically there will be people who stand out as getting it right consistently, even if only by chance. However humans have a bias towards relative comparisons over absolute comparisons and it is because our own track records lack notoriety that we ascribe such wisdom to these objectively banal results.

Every year there are thousands of male Bostonians with no more than a beer and a TV Remote who proclaim “This year, Tommy boy, he’s taking us all the way” during the first Pats game. 8% of the time these men are right.

My point is that there is more to genius than simply being right. Anyone can be right from the worst venture capitalist, to your common market watchmen, a horoscope in the New York Times, and even a fanboy in Southie can appear to have some insights unbeknownst to the common man.

When we latch onto the prognostications of these seers in the crowd because of their past insights we are liable to be wrong — the victims of false prophets.

Statistically any crowd will produce apparent seers, who because of their past insights (chance or otherwise), become trusted with the future.

The Genius in the Crowd

There is genius is being wrong. There is genius in failure. Both are accompanied with learnings.

The focus of a genius is not on how often they are right, but the means by which they reach their conclusions. Their methods, processes, habits, mental health, and discipline is the bedrock of their genius. It is the difference between a one-hit wonder (Rebecca Black) and sustained record of exceptional output (David Bowie). The former can come about as quickly as a coin toss, the later can take decades.

We’ve become obsessed with the quick win, the instant fame, the immediate gratification for each action we take. There are companies that sprout up every day which become successful by virtue being at the right place at the right time yet we ascribe genius to their methods, however good or bad. They entered a ferociously competitive market with no way of knowing if they’d come out on the other end, and yet, through a series of events they themselves can hardly articulate they soared to the top.

There is danger is following in the footsteps of these overnight successes and one-hit wonders. The forces that pushed them to the top may have very little to do with the methods they used along the way…like a sailboat in a hurricane…they end up where they ended up with little impact from the steering.

The ends never justify the means. A coin toss often performs better than the predictions. Do not put much stock in predictions and successes of old. They are great stories, but only stories. Most importantly, don’t get caught up in thinking you have to do anything like a Seer in the Crowd. Learn from them, but don’t reenact their lives.

- you don’t have to drop out of Harvard (twice) to be the next Bill Gates

- you don’t have to start a company with a college roommate to get into Y-Combinator

- you don’t have to move to Seattle and turn a blind eye to Silicon Valley/Alley to be the next Jeff Bezos

- you don’t need to follow X process from day one to be successful

Be you. Be true. You won’t standout from any crowd until you are willing to write your own story. Don’t leave it to chance.